Views: 0 Author: Site Editor Publish Time: 2025-07-17 Origin: Site

China’s mold export market is doing very well in 2024. The number of exports went up by 17%. Now, 68 million units are shipped out. The total value of these exports is $5 billion.

| Metric | Value/Change in 2024 | Additional Context |

|---|---|---|

| Export volume increase | +17% | After four years of going down, reached 68 million units |

| Export value in 2024 | $5 billion | Small growth |

| CAGR (2013-2024) | +6.1% | Average yearly growth over 11 years |

Chinese mold suppliers are still important in the world supply chain. They work with North America, Europe, Southeast Asia, and Japan. Their lower costs and big factories give them special chances. But there are problems too, like tariffs and changes in where companies buy molds. Knowing both the good and bad sides helps buyers and others make smart choices for the future.

China's mold export market grew by 17% in 2024. It reached $5 billion and shipped 68 million units. This shows the market is strong and important worldwide.

Chinese mold makers help save a lot of money. Their prices are 30-75% lower than in the US or Europe. This is because labor costs are lower. Factories work well and make products fast.

The industry spends a lot on new technology. They use CNC machines, 3D printing, and quality checks. These help make molds more exact and faster.

There are some problems in the industry. Too many small companies cause price wars. Many products look the same. There are risks of stealing ideas. Trade tariffs can hurt profits.

To do well, buyers and sellers should protect their ideas with legal papers. They need to check quality closely. Using smart contracts can help. They should use new technology and work with people from other countries.

In 2024, China’s mold export market was worth $5 billion. The market got bigger and stronger this year. Exports grew by 17% after going down for years. Now, China sends out 68 million molds. This makes China a top country in the mold market. Chinese makers sell molds to many countries. They keep growing and reaching new places. The steady rise shows Chinese companies are tough. They can change when the world market changes.

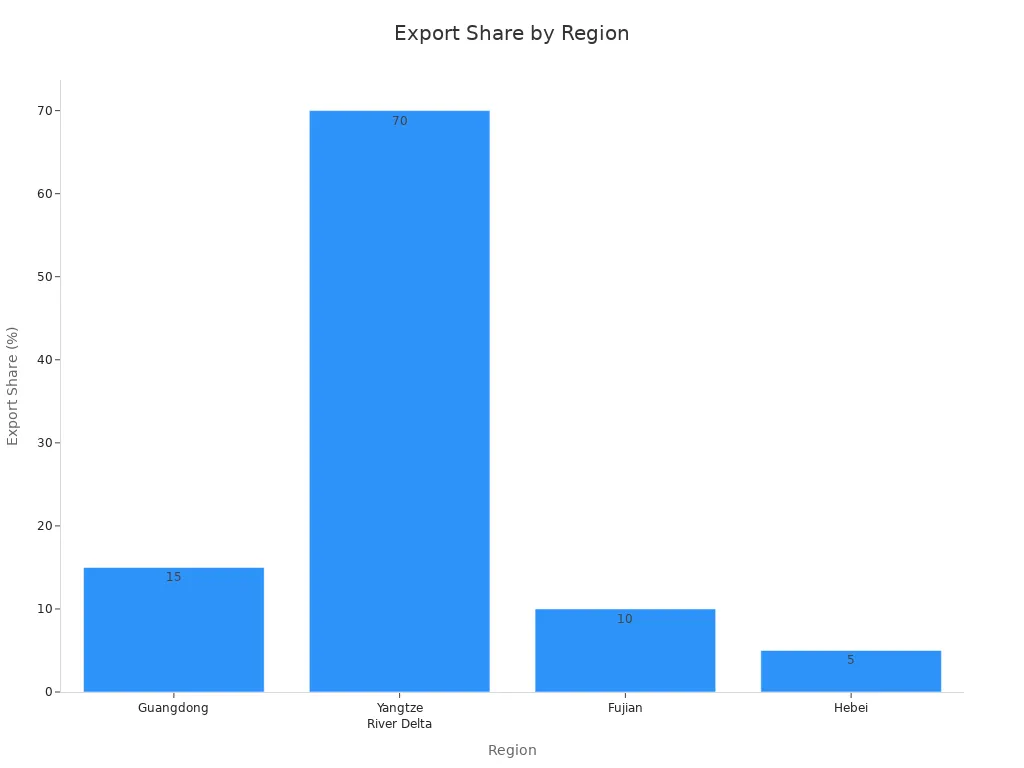

China’s mold export market has different parts. Plastic molds are the biggest part, about 45% of the market. These molds are used in cars, home items, electronics, and medical tools. Most factories are in the Yangtze River Delta, Pearl River Delta, and Bohai Rim. Cities like Shenzhen, Ningbo, and Suzhou make the most molds.

| Segment | Market Share | Key Application Sectors | Regional Clusters and Key Cities |

|---|---|---|---|

| Plastic Molds | ~45% | Automotive, Home Appliances, Consumer Electronics, Medical Devices | Yangtze River Delta, Pearl River Delta, Bohai Rim; Shenzhen, Ningbo, Suzhou |

Different regions in China do not grow the same way. Coastal areas like the Yangtze River Delta and Pearl River Delta grow faster. They have better technology and more money from other countries. These places also have better roads and buildings. Inland areas do not grow as fast. They have less money and fewer resources. This makes it hard for some makers to compete. Leaders in China see these problems. They work to help all regions grow and support the mold market.

China’s mold industry is very important in the world. It has big chances because of low costs and new technology. China also has strong supply chains. These things help Chinese companies make more molds for people everywhere. The next parts talk about the main chances for China’s injection mold industry.

China’s mold makers have a big price advantage. Their molds cost 30-75% less than those from the US or Europe. This is because workers in China get paid less. Factories work all day and night. They use machines all the time. There are many factories, so they can make lots of molds fast. The table below shows the main cost advantages:

| Cost Advantage Factor | Explanation |

|---|---|

| Price Difference | Chinese tooling prices are 30-75% lower than US manufacturers. |

| Labor Cost Savings | Toolmakers in China earn about $1,000/year, compared to over $40,000/year in the US. |

| Lower Training and Benefits | A skilled workforce reduces training costs and benefits expenses. |

| Lower Factory Overhead | 24/7 operations and full machinery use lower overhead costs. |

| Tariffs | Low or zero tariffs (0-3.8%) keep import costs down. |

| Massive Production Capacity | Over 7,000 injection molding facilities enable high-volume efficiency. |

| Lower Raw Material Costs | Domestic steel and supplier competition reduce material costs. |

| Quick Turnaround Times | Lead times are up to 50% faster than in the US, improving cash flow. |

Workers in China earn much less than in Western countries. This helps companies save 30-50% on making molds. Even if some materials are cheaper in the US, China’s supply chains and lower energy costs keep prices low. These reasons make China a top choice for mold making around the world.

China’s mold industry spends a lot on new technology. Top companies use CNC machines, 3D printing, and fast prototyping. They work in modern factories with strong quality checks. They help customers from design to finished molds.

| Innovation/Service | Description |

|---|---|

| Prototyping | 3D-printed or aluminum molds for small to mid-volume production |

| Mass Production | Multi-cavity steel molds for large-scale manufacturing |

| Bridge Tooling | Hybrid molds for mid-volume runs |

| Mold Flow Analysis | Predicts defects such as warping and sink marks |

| CMM Inspections | Ensures tolerances within ±0.005mm |

| T1 Sample Testing | Detailed inspection reports before mass production |

| Remote Troubleshooting | Video call support for mold maintenance |

| On-site Support | Local service centers for efficient repairs |

| Spare Parts Kits | Pre-shipped kits to minimize downtime |

Chinese companies use special machines like 4-axis and 5-axis CNC and EDM. They also use fast prototyping. These tools help China catch up with other top countries. More money goes into research and smart factories. Schools and research centers help with new ideas. All these things make China’s mold industry stronger.

More people want complex and precise molds. China can make these molds quickly and for less money. Some companies in China can finish molds in 3-4 weeks. In other countries, it takes over 8 weeks. China makes molds for cars, electronics, and medical tools. They are good at making special molds for each customer.

China fits well into world supply chains and delivers fast.

3D printing helps make samples quickly and with great detail.

China supports the world market with new technology and quick supply chains.

Chinese mold suppliers are important for car and home appliance companies. They make dashboards, bumpers, and lights for cars. They also make small, detailed parts for home items. Many Chinese companies have ISO 9001 and IATF 16949 certificates. This shows they care about quality.

Tip: Buyers should check quality, protect their ideas, and plan shipping when working with Chinese companies. These steps help buyers get the most from China’s mold industry.

China’s mold industry keeps growing in the world market. Low costs, new technology, and strong demand give China many chances. These strengths help China lead in mold making and stay competitive.

china's tooling industry has many problems as it grows. These problems affect everything from design to export. Companies need to deal with overcapacity, product sameness, intellectual property risks, and trade barriers. They must solve these problems to stay strong in the market.

china's tooling industry grew very fast in the last 20 years. Revenues went from $875 million in 2002 to over $7.6 billion in 2005. Guangdong province makes about 40% of all molds. But the industry is split into many small companies. Only a few make more than $10 million each year. Many factories do not use all their machines. This means there is too much competition and prices go down.

Mold exporters in China have to fight hard for business, so they lower prices, sometimes even below what it costs to make molds.

Companies use help from the government, tax rebates, and money from currency changes to keep going with low profits.

Big companies use their size and stock to keep working, even if they do not make much money.

Some businesses lose money on purpose to get more customers, hoping to make it back later with stock or loans.

Many try to save money by paying suppliers late or buying old machines.

Trying to grow too fast leads to price wars, less profit, and risky choices.

Because of overcapacity, it is hard for companies to buy new machines or make better molds. The fight for orders gets even harder as more companies join in.

Product sameness is another big problem in China's mold industry. Many companies make the same kinds of molds. This makes it hard for any company to be special. So, companies try to find new ways to stand out.

The main reason for sameness is that companies copy what works for others.

Companies need to come up with new ideas to win. Some, like Beijing Changhang Precision Casting Technology, have made new ways to make molds work better than those from Europe or America.

Others, like Shanghai Geometry Precision Machinery, make metal parts that are more exact and cost less.

Xi’an Western Superconducting Materials Technology has made better materials for medical devices.

These examples show that new ideas help companies break out of sameness. Better molds mean better products, especially for medical tools. Companies that spend money on research and work with others do better in the market.

Intellectual property (IP) protection is still a big worry for china's tooling industry. The risks include fights over patents, trademark problems, and people using mold designs without asking.

| Intellectual Property Challenge | Description | Risks/Consequences | Preventative Measures |

|---|---|---|---|

| First-to-File Patent System | China gives patents to whoever files first, not the inventor | Losing patent rights, expensive court cases, being left out of the market | File patents quickly in China before others do |

| Trademark Squatting | Others register foreign trademarks without permission | Brand gets weaker, confusion in the market, costly legal fights | Register trademarks early, watch for people copying them |

| Unauthorized Use and Replication of Molds | Sending mold samples without legal protection | IP theft, molds made without permission, more competition | Use NDAs, NNN agreements, and other contracts |

| Lack of Proper Legal Safeguards | No contracts to protect IP | Losing money, losing the right to sell | Use NDAs, NNN contracts, and other legal papers that follow Chinese law |

Sometimes, companies send mold samples to Chinese factories without legal protection. This can lead to IP theft and molds being copied. There have been big cases, like stolen wind turbine software and chemical secrets. Losing IP can cost a lot of money. To protect their ideas, companies should use NDAs, NNN agreements, and file patents early in China. These steps help companies stay ahead in the world market.

Note: Mold buyers should always use legal protection before sharing designs or samples. This helps stop IP theft and keeps their products safe.

Trade barriers and tariffs are still big problems for China's mold exporters. The United States doubled steel tariffs to 50%, making it cost more for local toolmakers. This makes Chinese steel molds cheaper by comparison. But tariffs on precision injection molds and medical molds add extra costs for exporters.

| Aspect | Evidence |

|---|---|

| Tariff Rates | 25% tariff plus 7% safety fee on precision injection molds; 5% tariff on medical molds until 2025 |

| Export Volume Changes | China's mold exports to the U.S. fell 18.7% in 2024; exports to the EU went up by 23% |

| Cost Impact | Tariffs, shipping costs, and exchange rates cut profits from 18-22% (2019) to 8-12% (2024) |

| Supply Chain Shifts | Companies like Tesla ask Chinese suppliers to build factories in Mexico; Chinese firms invest in North America |

| Technological Barriers | Limits on high-end CNC exports and patent rules push local innovation and replacement rates up to 45% |

| Market Diversification | Focus on ASEAN markets with 14% yearly growth; local replacement in new energy vehicle molds rising from 55% to 82% by 2025 |

| Technological Upgrades | Using AI design, digital twin systems, and new materials to avoid tariff problems |

| Policy Support | Export rebate goes up from 9% to 13%; benefits from RCEP and China-EU CAI free trade deals |

| Supply Chain Resilience | Modular production and assembly in EU and ASEAN countries to avoid tariffs |

| Competitive Advantage | Even with tariffs, higher U.S. steel tariffs make Chinese steel molds cheaper worldwide |

Many companies now keep molds in China and only ship finished plastic parts to avoid tariffs. Some move factories to places like Mexico or use new technology to lower risks. The moldmaking industry must change to keep its place in the world supply chain.

China's mold industry faces many hard problems that need smart planning. Overcapacity, sameness, IP risks, and trade barriers all shape the market. Companies that solve these problems can stay strong in the fast-changing world of moldmaking.

Chinese manufacturers work hard to make better products. They follow rules from around the world and in China. Many companies, like Mold Parts Factory, use ISO 9001 systems. They use special design software to find and stop problems early. Workers get training to learn new skills and care about quality. Factories check products during each step to keep them the same. They use numbers and charts to watch for mistakes. After selling, they help customers with warranties and listen to feedback. Going to trade shows lets them show new ideas and find more buyers.

Follow world standards

Use smart design software

Train workers often

Give good help after sales

China’s injection mold industry spends a lot on new machines. Companies like Himile and Huari Group make special robots and tools that save energy. These new machines help factories work faster and better. Companies use digital twins and machine learning to stay ahead. They also use new materials to make strong molds. Working with European partners helps them learn new skills. This makes Chinese companies stronger and helps them sell more around the world.

| Innovation Area | Impact |

|---|---|

| Robotics & Automation | Makes work faster and more exact |

| Advanced Materials | Molds last longer and work better |

| Digital Transformation | Saves energy and time |

Factories in China try to help the planet. They use plastics that can break down or be used again. They buy machines that use less energy. Molds are made to last a long time. Some companies recycle old plastic and use it again. They plan shipments to use less fuel. These steps help the earth and give people greener choices.

Use plastics that are safe for nature

Buy machines that save power

Recycle and cut down on waste

Chinese companies team up with others in Europe, North America, and Southeast Asia. They join big supply chains and share new ideas. These teams help Chinese companies reach more places and make better molds. By working with top companies, they learn new ways to build things. This helps them stay strong in the world market.

Note: Working with other countries and always finding new ideas helps China’s injection mold industry keep up with changes and rules.

Europe wants very good molds from exporters. Buyers there care about the environment and new technology. They also want molds made with great detail. Many European factories use smart computers to design and make molds. They try to be green and use less waste. More than 10% of molds in Europe are made from recycled stuff. This makes Chinese companies work harder to be cleaner and smarter.

| Aspect | European Market | Impact on Chinese Exporters |

|---|---|---|

| Sustainability | Over 10% recycled molds | Must use eco-friendly ways |

| Technology | 70%+ use CAD/CAM | Need better digital tools |

| Specialty Demand | High for cosmetics, beverages | Must make precise molds |

| Trade Barriers | EU anti-subsidy tariffs | Face tough rules |

Chinese companies buy new machines and use robots to keep up. But taxes and trade fights make it tough to sell in Europe. The need for perfect molds and following rules changes how the market works.

North America is still very important for mold makers. People there need molds for cars, medicine, and home goods. They want their orders fast and want top quality. The US put higher taxes on some Chinese molds, so selling costs more. Some Chinese companies build factories in Mexico or Canada to skip these taxes.

Customers in North America like new ideas and good help after buying. Chinese companies must give great service and use new technology to win. If they are quick and make good molds, they do well in this market.

Southeast Asia is growing fast in mold making. Countries like Vietnam and Cambodia pay workers less than China. This makes it harder for China to stay the cheapest.

| Factor | China | Vietnam | Cambodia |

|---|---|---|---|

| Labor Cost (per hour) | $4 - $6 | $2 - $3 | $1.5 - $2.5 |

| Tooling Expenses | Baseline | 25-30% lower | N/A |

| Development Cycle | 4-6 weeks | Longer | N/A |

| Technical Capability | Advanced | Less advanced | N/A |

China is still faster at making molds and has better tools. Its factories can make lots of molds at once. But more local companies in Southeast Asia means China sells less there. To stay ahead, Chinese companies must use better technology and work faster.

Japan wants very exact molds and great service after buying. Chinese molds do not always match German or Japanese ones. They sometimes break or need fixing more often. This makes it hard for Chinese companies to sell there. Also, workers in China cost more now, so prices are closer to Japan’s.

Japanese buyers want the best quality and long-lasting molds.

Chinese companies use special computer tests to make better molds.

Smart factories help fix mistakes and save money.

Money changes and expensive materials can hurt profits.

Chinese companies must invent new things and be good to customers to win.

To do well in Japan, companies must change fast and use new machines. Working with others and giving better service helps Chinese companies do better in this tough market.

China’s mold export market will likely keep growing until 2025. Experts think it will grow about 8% each year. This is because more people want molds for cars, packaging, and buildings. The government helps by supporting new technology and smart factories. Many companies now use robots and computers to make molds faster and better. By 2025, about 60% of Chinese mold companies will use smart factory tools.

The tables below show what helps the market grow and what makes it hard:

| Key Factors Driving Growth | Supporting Details |

|---|---|

| Government support for technology | China wants 70% of its own tech by 2025 |

| Robust domestic demand | More people need packaging and car molds |

| Smart manufacturing adoption | Using IoT and robots makes work faster |

| Sustainability focus | Factories use green materials and save energy |

| Challenges and Restraints | Details |

|---|---|

| Geopolitical tensions | Trade fights and tariffs make things cost more |

| Competition from emerging markets | Vietnam and India get more factories |

| Skilled labor shortages | Not enough trained workers for hard jobs |

People who buy molds and others in the industry can use some smart steps to do well in China’s mold market:

Make clear contracts that say what the product is, how good it should be, when it will come, and how to pay.

Keep ideas safe with NNN agreements and by registering patents in China.

Check suppliers closely and use local agents to watch quality.

Inspect products often during making to find problems early.

Use safe ways to pay and keep extra stock to stop delays.

Look at designs early to stop mistakes before making molds.

Try the China+1 plan by making some molds in Vietnam to keep the supply chain strong.

Chinese mold makers should buy better machines, train workers, and work with big companies. They should also use the strengths of places like Guangdong and the Yangtze River Delta to stay ahead in the world market.

Tip: Companies that learn new technology fast and follow world changes will be leaders in the next few years.

China’s mold export market has big chances and some problems. Companies are growing fast and using better technology. More people around the world want their molds. But there are not enough workers, costs are going up, and there is a lot of competition.

Experts say automation, new materials, and making more exact molds are important.

New ideas and working with other countries help Chinese companies make better molds and keep up.

| Key Focus | How It Helps Companies |

|---|---|

| Innovation | Makes molds faster and more exact |

| Collaboration | Lets companies learn from others |

| Sustainability | Helps meet world rules |

Watching these changes will help sellers and buyers do well as the world market keeps changing.

Chinese mold suppliers use ISO 9001 and IATF 16949 standards. Many factories also meet rules from Europe, North America, and Japan. These standards help make sure the molds are good and work well.

Making molds takes about 3 to 6 weeks. The time depends on how hard the mold is to make. Shipping by air takes 3 to 7 days. Sending by boat takes 2 to 5 weeks. Fast work helps Chinese suppliers stay ahead.

Buyers should sign NDAs and NNN agreements before sharing designs. Registering patents and trademarks in China gives more safety. Legal contracts under Chinese law help stop copying or stealing.

Tariffs can make molds cost more in the US and Europe. Some companies move work to other countries or keep molds in China to save money. Watching trade rules helps buyers lower risks.

Buyers should check if suppliers have the right certificates. They should look at old projects and ask for sample parts. Visiting factories or using third-party checks helps make sure of good quality. Clear contracts and talking often help build trust.

Tip: Always check if the supplier is real and use written deals to stop problems.

content is empty!

content is empty!

ZHUHAI GREE DAIKIN PRECISION MOLD CO., LTD.